Aug 1, 2024

DAMM Capital 2024 Q3 Quarterly Report

August 2024, Quarterly Report

Welcome to the first of many DAMM Capital quarterly reports. Our goal with these reports is to keep our clients informed about the ongoing development of the decentralized finance ecosystem, provide insights into DAMM Capital's performance and future direction, and explain the strategies and decisions driving our progress.

Market Overview

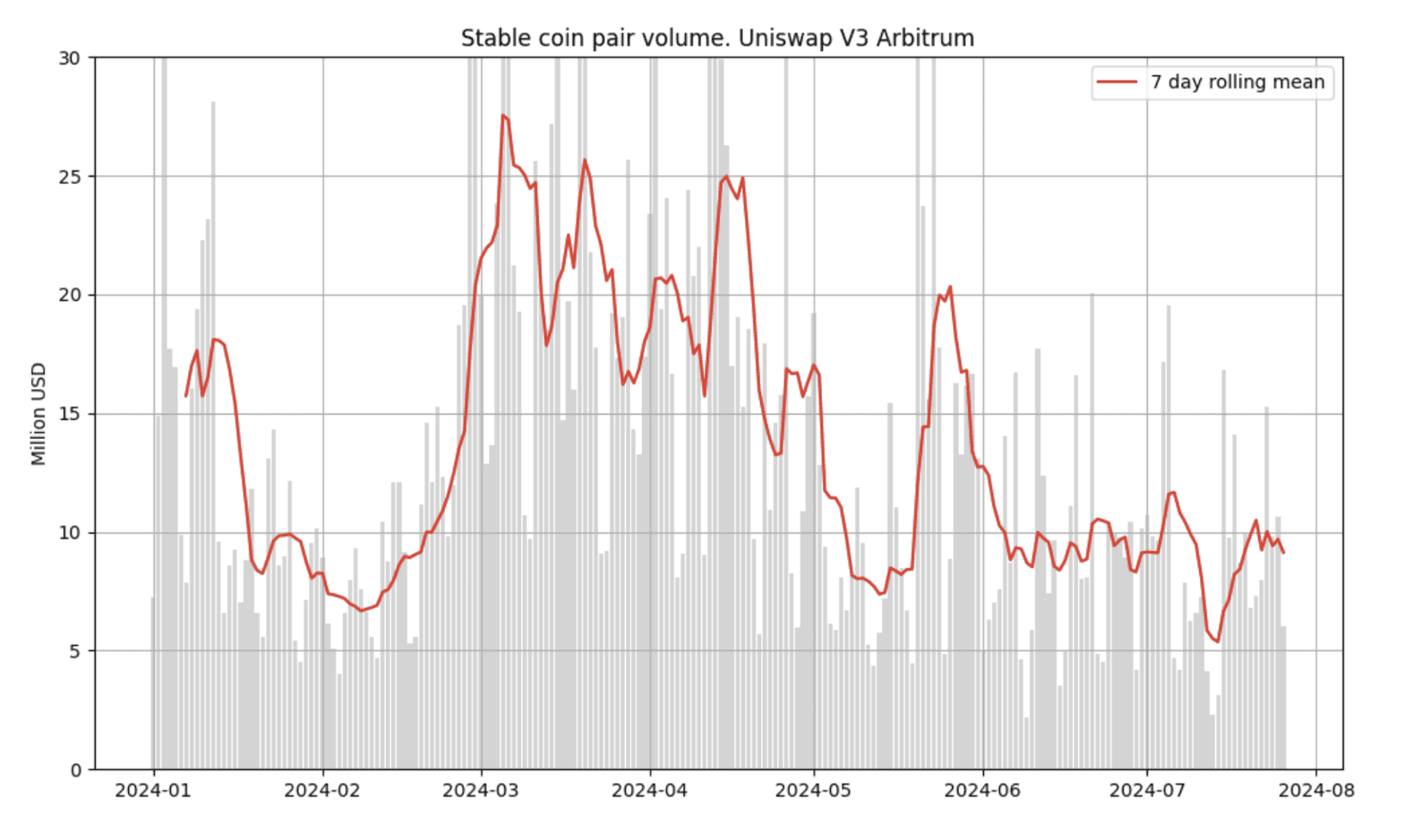

Our primary income stream comes from Uniswap V3 stable coin pairs on the Arbitrum network. Throughout the first half of January, all of March and April, and at the end of May, we experienced robust stable pool volume. Outside these peak periods, the daily volume has hovered just below $10 million USD.

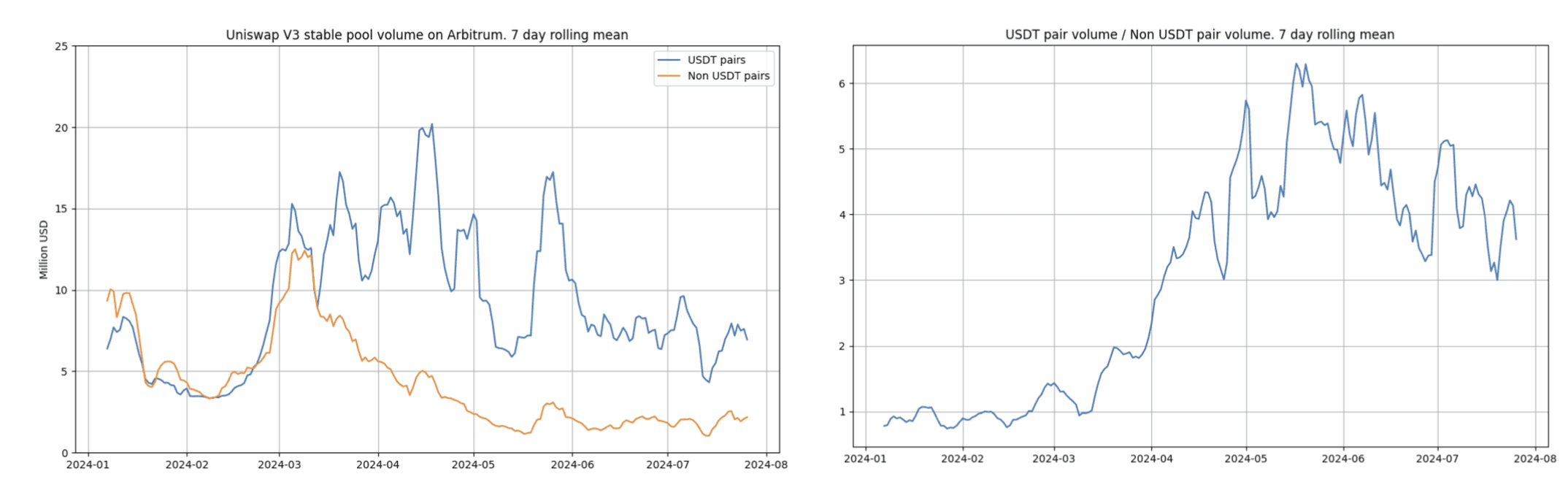

Stable coin pairs in our portfolio can be classified into two main categories: less volatile pairs, which do not involve USDT, and more volatile pairs that include USDT. Historically, both categories have displayed similar volume, making less volatile pairs more attractive from a risk-adjusted perspective. For this reason, we optimized our systems to work best with these pairs. In mid-March, however, the volume relationship between the two categories broke down, with more volatile pairs having as much as 6 times the volume found in less volatile pairs.

In response to this market shift, we adjusted our strategy to focus more on volatile pairs. Low volatility pairs require cutting-edge, real-time data feeds and analytics. Higher volatility pairs share these requirements, but also demand 24/7, automated trading bots, which are algorithms that automatically execute trades based on real-time market data to optimize portfolio performance. After months of development and testing, our first bot is now in beta and is set to be available to our clients within the next month or two. This bot will enhance our ability to invest in volatile pairs with the necessary precision, speed, and uptime, while also representing a significant milestone towards offering a wider array of products.

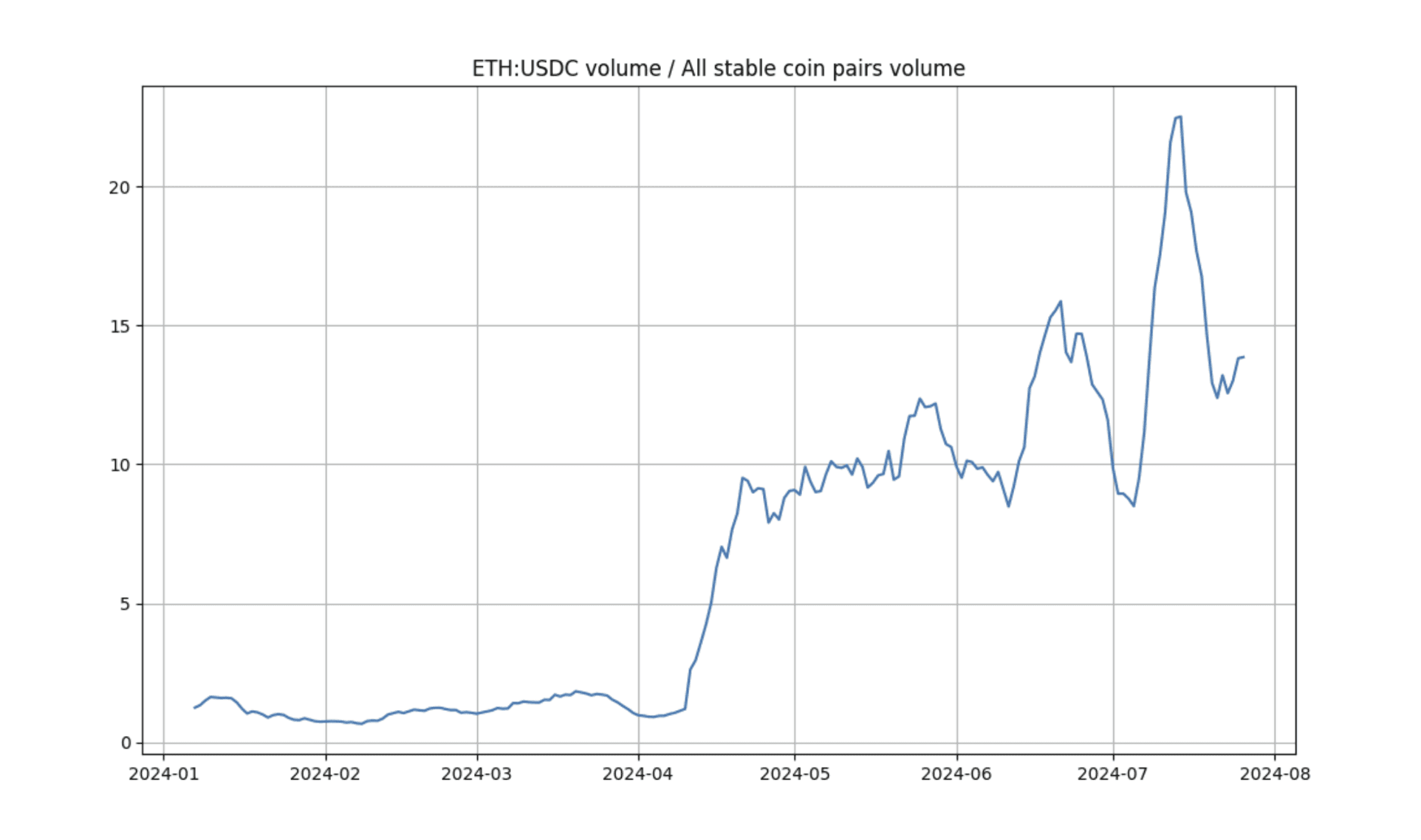

Over the last couple of months, stable coin pairs have averaged a combined daily volume of around $10 million USD. Notably, the ETH/USDC pair alone has seen daily volume of $120 million USD, and as much as $240 million USD. Such high volume pairs tend to also have high volatility. Our volatile stable coin bot can be adapted to work on more volatile pairs, and is thus the foundational building block for taking advantage of these opportunities. Though the development of a high volatility bot is in the early stages, progress is swift. Our goal is to offer two distinct funds to clients: a stablecoin money market fund and a high-volume volatile pair fund with a higher risk-return profile. We plan to launch the latter this year, leveraging our advanced bots to optimize performance and capitalize on market opportunities.

Protocol

We are nearing the completion of the development of the first DAMM smart contract protocol, marking a significant milestone in our journey towards decentralizing DAMM funds. This protocol represents a pivotal step forward, enabling users to deposit and withdraw funds without the need for intermediaries. By leveraging the power of blockchain technology, we are shifting the responsibility of custodying user funds away from the DAMM team and embracing the ethos of self-custody. Clients who are more experienced in crypto will have the option to self-custody their funds, while those less familiar with the intricacies of crypto will still have the option of DAMM custodying their funds.

Initial versions of the protocol are already undergoing testing in production, integrated with the previously mentioned bot systems. This real-world testing phase is crucial to ensure the protocol's robustness and efficiency. Before any client funds are deposited, the protocol will undergo a thorough audit by third party security professionals. We prioritize security above all else, and this aspect of our development process is non-negotiable.

In the coming month, we will be launching our brand-new landing page and client dashboard. The dashboard will provide clients a real-time visualization of their investments, offering transparency and ease of access. Additionally, it will showcase all the funds actively managed by DAMM Capital, giving clients a comprehensive view of their investment portfolio and the performance of our various funds. This new interface will enhance the client experience, providing them with the tools and information they need to make informed investment decisions.

Partnerships and Collaborations

DAMM Capital has been actively developing relationships with leading protocols and institutions across the crypto and DeFi landscape. Our efforts are focused on building strong, strategic partnerships that will enhance our capabilities and expand our reach.

One of our key protocol integrations will be with Kleros, a decentralized judiciary court system on the Ethereum blockchain. This integration aims to fully decentralize our protocol and eliminate potential attack vectors stemming from conflicts of interest or malicious actors. By leveraging Kleros, we ensure that client funds remain secure and accessible for withdrawal under all market conditions, reinforcing our commitment to transparency and trust.

We are excited to announce that DAMM Capital has been invited to join the Crecimiento movement as a signature startup at the Aleph Pop-Up City event this August in Buenos Aires, Argentina. This prestigious opportunity will allow us to showcase our vision to a global audience of clients, industry leaders, and investors. We aim to forge lasting partnerships that will help us realize our goals and build out our vision for the future of decentralized money management.

In addition, DAMM Capital will be attending Eth Devcon this November in Bangkok, Thailand. As the largest developer conference within the Ethereum ecosystem, Devcon provides a unique platform to connect with industry leaders and developers from around the world. Held annually at different locations, this event is a prime opportunity for us to establish and strengthen relationships that could be leveraged to further our mission. We look forward to capitalizing on these opportunities to drive innovation and collaboration in the DeFi space.